Nyhet! Vi har lansert ny nettside. Del gjerne feedback enten på epost eller på Jodel.

Annonsere?

Annonsere?

Nyhet! Vi har lansert ny nettside. Del gjerne feedback enten på epost eller på Jodel.

Annonsere?

Annonsere?

President Nicolas Maduro was first elected in 2013 after the death of his predecessor Hugo Chavez, leading to years of political turmoil and economic crisis, including rapidly increasing hyperinflation, poverty and shortages in food and medicine. During the following early elections in 2018, many oppositional candidates were excluded from the vote, resulting in most of the opposition boycotting the election and calling it fraudulent.

On 10 January 2019, Maduro’s inauguration for his second six-year term of presidency took place, not recognized by the Organisation of American States and the United States. That event caused the biggest protests against Maduro in two years and the opposition-controlled National Assembly declared the presidency as vacant. Subsequently, the Supreme Court named actions by the National Assembly as void but nevertheless, opposition leader Juan Guaido declared himself as interim president on 23 January 2019 and promised amnesty to all military members turning away from Maduro. Since then, Venezuela has been facing a battle for power between the two competitors with the international interference of several powerful countries (see figure 1).

Current humanitarian and economic situation

Today, the people in Venezuela suffer from Hyperinflation and shortage of food and medicine, which leads to increasing poverty, starving and illness. However, Maduro denies the presence of a humanitarian crisis, prevents aid supply from the U.S. entering the country and announced instead that paid Russian goods are on the way. At the same time, Maduro and its opponent Guaido compete over the people’s support and thereby their power with organizing aid deliveries and charity events.

The number of asylum seekers from Venezuela increased exponentially from about 4,000 in 2014 to more than 232,000 in 2018, which lead to more than 3 million migrants and refugees from Venezuela globally with the majority of them moving to other Latin American countries. This number is projected to rise by more than 2 million up to over 5 million Venezuelans in 2019.

The inflation rate in Venezuela could be considered as relatively stable in the 30 years before 2015 with values in between 10 and 100 percent annually but then increased exponentially from 112 percent in 2015 up to a level of 1.37 million percent in 2018. For 2019 and the following years, annual inflation rates of about 10 million percent are projected.

The resource curse and other drivers of the crisis

The possession of resources does not necessarily lead to economic improvements within countries and can even have strong negative development effects. If a country clearly faces disadvantages related to their resource-wealth, that phenomenon is called the “resource curse”. Empirically, there are several reasons for potential resource curse effects, for instance the dependence of the countries’ economies and governmental budgets on volatile commodity prices. Another harmful factor can be the crowding out of other sectors, which were beneficial to the economy as well as poor institutions, such as corruption, inequality, class structure, chronic power struggles, and the absence of rule of law and property rights.

All of these aspects in a certain degree apply to the development in Venezuela, which relies on its oil industry at the expense of other sectors of its economy. However, the country’s oil industry is especially vulnerable to fluctuating prices and additionally, there was a lack of investments in efficiency improvements of the production, leading to an economic inability of oil extraction despite the possession of the most proven oil reserves globally.

Responding to a written inquiry, Corbett Grainger (Associate professor at the University of Wisconsin and guest professor at NHH) calls Venezuela a clear case of the resource curse and names the weak institutions as one of the main drivers. He claims that, “the lack of strong institutions is potentially endogenous, meaning that the oil wealth has prevented the country from creating strong institutions to protect its resources.” Furthermore, he blames the mismanagement of the national currency for the “collapse of the economy and the political instability”.

The CIA states the falling oil prices since 2014 and the low cash flow of the state oil company PDVSA, as well as rigid labour regulations and price and currency control as main drivers for the further tightening of the economic crisis in Venezuela. In response to that, the Government increased state control over the economy and expansionary monetary policies, which aggravated the situation.

Inside Venezuela, critics of the government claim that Venezuela's economic crisis was caused by economic mismanagement and corruption, but government supporters blame exogenous effects such as falling oil prices, international sanctions, and the country's business elite for Venezuela's troubles.

Comparison to Norway and outlook

Venezuela slid into the resource curse due to weak economic, political and social institutions, leading to the mismanagement of resources, widespread corruption and excessive state intervention. Norway in the opposite managed to overcome a potential resource curse with futuristic policies, systematized governance and structured oil wealth management. All of the petroleum-related governmental net revenue in Norway flows into the Government Pension Fund Global (also known as “Oil fund”), which was set up in 1990 in order to balance declining future petroleum revenues and to ensure an intergenerational long-term resource rent with investing the capital abroad in avoidance of overheating Norway’s economy.

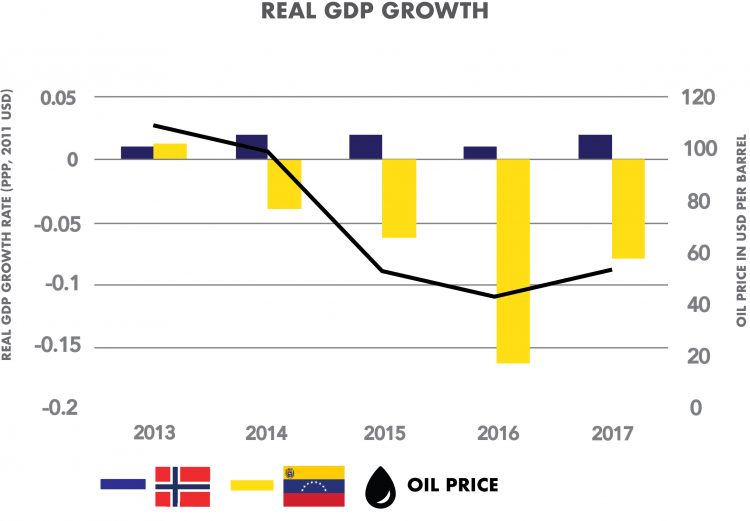

There is also a substantial difference in the reliance on oil in these two countries with oil exports accounting for 90 percent of the Venezuelan government’s revenues and for 95 percent of the foreign currency earnings, whereas in Norway the government’s revenues from the oil industry amounted to around 19 percent of the budget in 2018. Therefore, Norway’s more diversified economy is not as vulnerable to oil price shocks as Venezuela’s (see figure 2).

Grainger states the differences in institutions, the infrastructure, the risk of expropriation and the transparency of the government as major factors leading to different developments of Norway and Venezuela. The latter is demonstrated by the corruption index CPI, which ranks Norway on 7 and Venezuela on 168 out of 180 evaluated countries worldwide.

However, in a personal interview he also mentions that it is unclear, if Norway also faced some negative impacts of the resource curse in the past. Therefore, there are post-boom evaluations needed in order to analyse for instance a potential misallocation of human capital. Regarding Venezuela, Grainger states that they need to get back control over their currency and restructure their economic system in order to overcome the resource course.

Currently, the tensions in Venezuela are increasing and the country is in danger of an outbreaking civil war. However, if they manage to regain stability and establish the right economic and political framework, Venezuela would be able to benefit from their resource abundance and low cost production potential and create enormous wealth.

Sources: Al Jazeera, Associated Press, BBC, CIA Factbook, CNN, EIA, Financial Times, Forbes, IMF, IOM, Norges Bank, Norwegian Ministry of Petroleum and Energy, OPEC, UNDP, UNHCR, Reuters, Rystad Energy, Transparency International, White House, Worldbank.

Corbett Grainger; Frankel, J. A. (2010); Kumar, Toshniwal & Gupta (2016)

Also read:

Hvis du noen gang utveksler til Rotterdam School of Management